Share

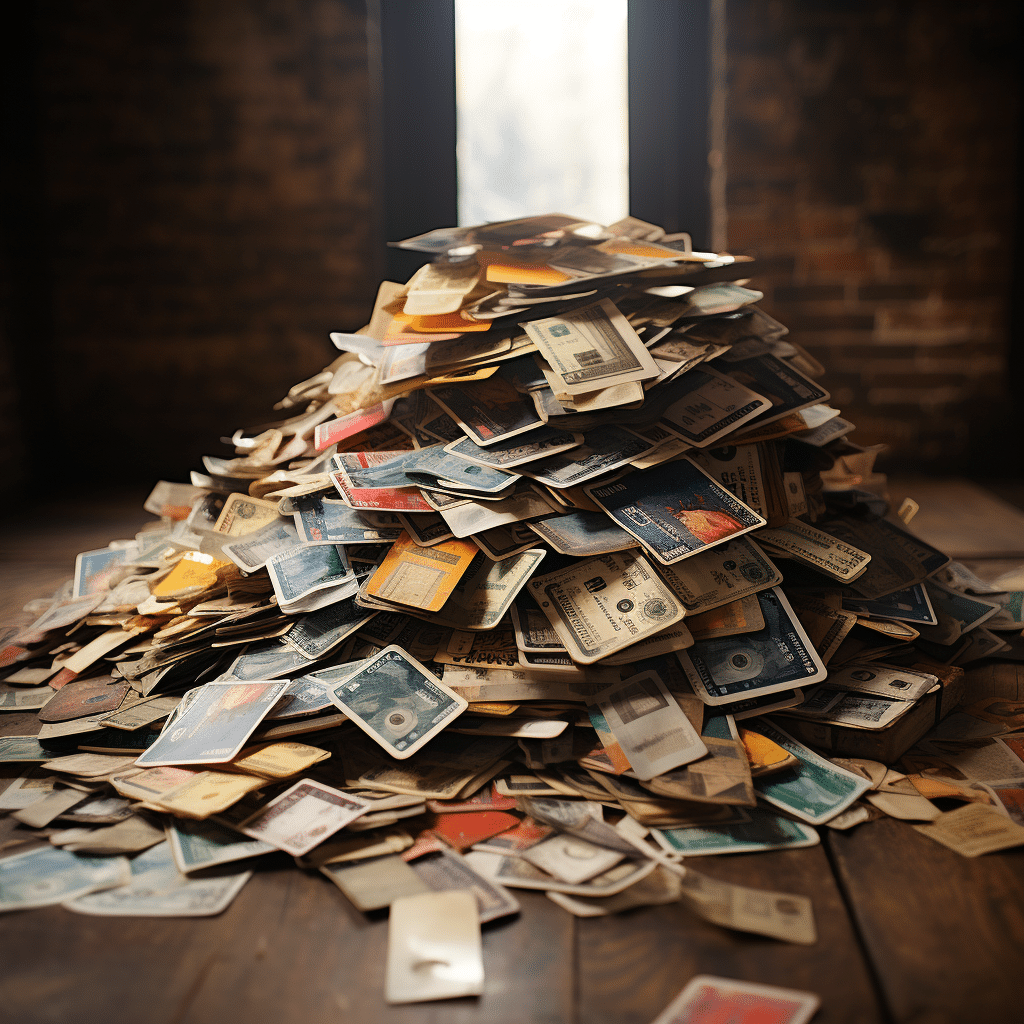

A disturbing trend is happening with the California Middle Class Tax Refund (MCTR): people are getting their cards and finding out the money is all gone shortly after they use them for the first time. That’s even though they’re brand new and just got out of the envelope. How could that even happen? Over 1 million people in California still haven’t claimed their middle class tax refunds, and this is a big reason why.

What’s going on is that many of the cards were shipped without security chips. A company called Money Network issued around 8 million of the cards – with billions of dollars in them. But consumers and the media are reporting that their cards are getting drained of all their money almost immediately after the first time they use it. And they do it over the Internet.

If this happened to you, our attorneys want to talk to you. Kneupper & Covey is a law firm that works to protect consumers with class action lawsuits. If money has been stolen from your Middle Class Tax Relief card, you may be entitled to pursue a class action to help recover money from everyone this has happened to.

Click Here to Submit Your Claim. and our attorneys will review your case and contact you.

What is the Middle Class Tax Refund?

It’s a card that was sent to people in the middle class in California to try to reduce the impact of inflation. Essentially it acts as a tax refund. You may have gotten in the mail, and they were sent to people without even expecting it. Some people even threw it away as junk mail. The idea was that in the last few years, everyone has been hit hard financially. So the money we pay taxes for was supposed to go out to some of the people who were hardest hit. If it gets stolen, that doesn’t happen. Not only do your taxes get wasted, but the families who need it are in an even harder spot.

How did people steal money off my Middle Class Tax Relief card?

How is it possible that people could be stealing off of my Middle Class Tax Relief card? Without the security chips, your inflation relief card is completely unprotected. There are lots of ways that someone could get your card information, but one of the big ones is something called a “skimmer.” This is a device that scammers go around secretly installing in the card reader for gas pumps, ATM’s, or other unprotected places you could be scanning your card. And if you run a card through without a security chip, the skimmer copies your card and sends the information to the scammers, who then use it for online transactions.

Can I get my money back from the hackers?

Probably not. No one even knows who they are, and they may not be in the United States. Once people collect the card numbers with the skimmers, they may just sell it overseas on the Dark Web. But that doesn’t mean that the banks are off the hook if they were negligent.

Who is Money Network Financial, LLC?

Money Network is one of the companies that was responsible for issuing the Middle Class Tax Relief cards and giving people their money. They do prepaid cards in general, so they’ve got experience in this area. They’re a big company related to a big bank called First Data. But news sources are reporting that they’re the ones who didn’t put the security chips on the cards, even though that’s a standard protection. We’re investigating those reports, and we want to find people who may not have had a security chip on their cards and had money stolen from them by hackers or scammers. Money Network had a job to do – an extremely important one. When banks leave the people’s money vulnerable, then they bear responsibility for that.

How can a class action lawsuit protect Californians from these hackers?

The hackers aren’t the only ones responsible. Several big companies were paid a lot of money to do a job: to get our tax dollars safely to the people who needed it. But if they didn’t do that job, the one we paid them for, then it’s fair for people to start asking why. And it’s fair for there to be consequences. If you didn’t do a job you were getting paid for, you’d expect something to happen to you. So why do the biggest companies in America get off the hook?

Our firm believes that big corporations should take responsibility if something goes wrong. If Californians lose millions of dollars because basic precautions weren’t taken, then the people who didn’t protect us should be held responsible for it. And inflation relief funds are the people’s money. We all paid taxes for it – so why should scammers and hackers get it instead of the average person who was supposed to use it to pay for groceries, their car payment, or their electric bill?

A class action lawsuit is where a few people represent a large group of people. They act as the “class representative,” which is just the person who sues for everyone else. Then the lawsuit goes ahead just like any other lawsuit does, but with a way to recover money for a lot more people. If there’s a settlement, or a jury verdict, then the money is distributed out to the people who were victims of whatever the bad behavior was that you’re suing over. The class representative is just an ordinary person who does their civic duty and lets their own personal lawsuit act as a way to help everyone else as well.

Help our lawyers fight back against big companies that don’t do what they’re supposed to. If you had money drained off your Middle Class Tax Relief card, fill out our survey and you may be able to help get money back for you and everyone else who was a victim of this.